income tax act malaysia

Date of coming into operation. How To Declare Rental Income In Malaysia.

Malaysia Tax Exemption On Foreign Sourced Income Rodl Partner

Under the old income tax regime a higher tax exemption limit is available to senior citizens and super senior citizens.

. Enabling tax and accounting professionals and businesses of all sizes drive productivity navigate change and deliver better outcomes. It was implied by James Wilson to overcome heavy losses suffered by the British Government due to Indias freedom movement in 1857. Revised up to.

Malaysia unveiled a leaner budget of RM3723 billion US8006 billion for 2023 on Friday Oct 7 amid an uncertain global environment and an expected slow growth. Nevertheless taxpayers shall continue to be qualified for a tax deduction for income tax received outside India per Sec. CTEC 1040-QE-2662 2022 HRB Tax Group Inc.

Given below are the income tax rates for FY 2021-22 AY 2022-23 and FY 2022-23 under the old tax regime. There is no ceiling in monetary terms in the Income Tax Act in article 276 of the Constitution. Malaysia for the past six years.

21st October 1971 _____ ARRANGEMENT OF SECTIONS _____ Long Title PART I - PRELIMINARY Section 1. Effective from FY 2022-23 gains from various virtual digital assets such as bitcoin dogecoin non-fungible tokens NFTs etc. Efiling Income Tax ReturnsITR is made easy with Clear platform.

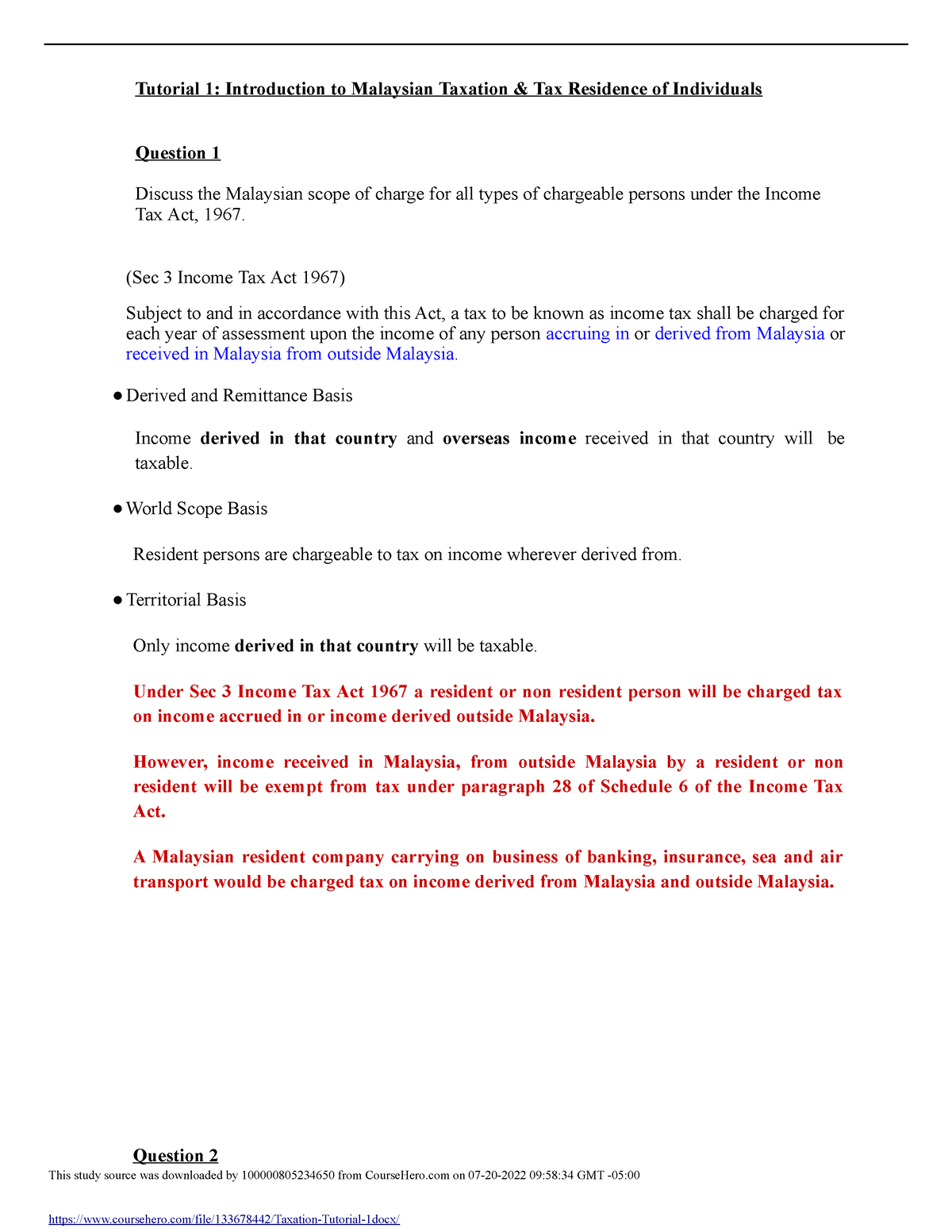

Income Tax Act 1959 Being an Act to impose a tax upon incomes and to provide for its assessment and collection. Updated with latest tax. According to Section 45 of Malaysias Income Tax Act 1967 all married couples in Malaysia have the right to choose whether to file individual or joint taxes.

As a general rule of thumb if both spouses are earning high incomes in the year of assessment it is always recommended to opt for separate assessment to leverage on the tax reliefs. The 2022 budget. Use for Tax Computation IT or Investment Declaration with your employer.

The history of Income Tax in India is divided into 3 different periods. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. During the Income Tax Course should HR Block learn of any students employment or intended employment with a competing professional tax preparation company HR Block reserves the right to immediately cancel the students enrollment.

The double tax treaty tells Mark that the UK has the main right to tax the income and that if Germany also wants to tax it then the foreign tax credit method should be used to avoid double tax. Expatriates may benefit from a special tax regime exemption on their income if the following two conditions are verified. Currently the Income Tax Act 1961 is.

Short title and commencement. Tax Accounting. INCOME TAX ACT 1967 REPRINT - 2002 Incorporating latest amendments - Act A11512002.

Under Part II Section 7 of the Income Tax Act 1967 the Malaysian government considers any individual regardless of. With workflows optimized by technology and guided by deep domain expertise we help organizations grow manage and protect their businesses and their clients businesses. This Act may be cited as the Income Tax Act 1959.

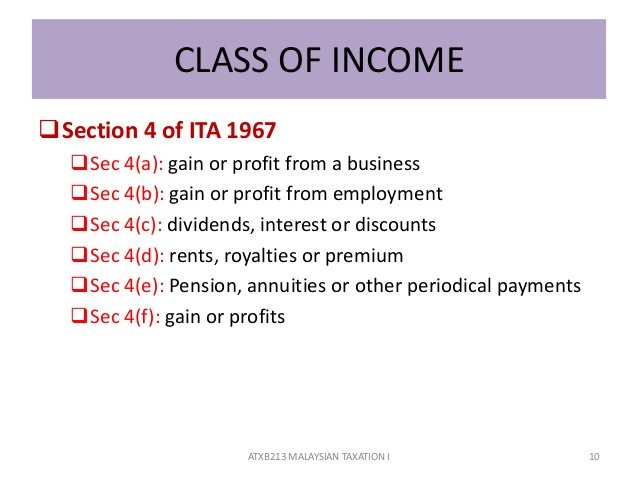

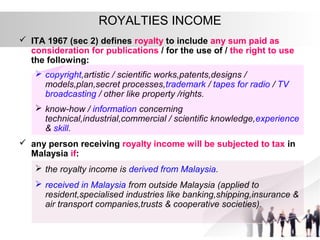

Income under Section 4f refers to gains and profits not covered under Sections 4a to 4e of the Income Tax Act 1967. Under the Section 11A on the Income Tax Act equity and equity shares funds that have been sold in stock exchange and securities transaction tax on such short-term capital gains is chargeable to tax at a rate of 10 percent up to 2008-9 and 15 percent from 2009-10 onwards. An estimated 50 of Irans GDP was exempt from taxes in FY 2004.

Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is. A bank licensed under the Islamic Banking Act 1983. Just upload your form 16 claim your deductions and get your acknowledgment number online.

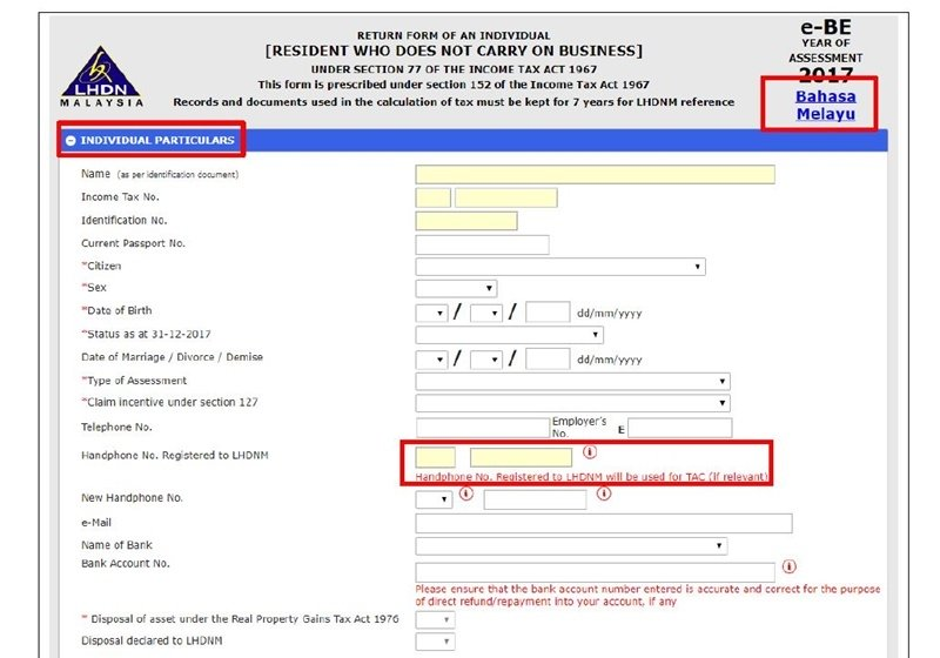

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021. With effect from 1 January 2009 a withholding tax mechanism to collect withholding tax at 10 on other types of income of non-residents under Section 4f of the Income Tax Act 1967 has been introduced. Tay the 75-year-old founder of Direct Funeral Services was handed three charges under the Income Tax Act an Undertaker Roland Tay charged with evading S427000 in income tax failing to.

Any State Government is not eligible to impose more than Rs2 500 annually as professional tax. A new section 115BBH has been inserted into the Income-tax Act 1961 for taxation of virtual digital assets. 40 of the Income-tax Act.

Lets make sure you know how to declare yours properly. Individuals who own a property in Malaysia that isnt used for business purposes and receive a rental income are subject to. Income-tax Second Amendment Act 1998 11 of 1999 Finance Act 1999 27 of 1999 Income-tax Amendment Act 1999 28 of 1999.

Calculate income tax for an individual or HUF based on the given total income and deductions. According to the document organisations are requested to issue official tax exemption receipts only for donors who have provided all required particulars. An individual is considered a Senior Citizen if an individual crosses the age of 60 years during the financial year.

That means he has resided in India for 449 days in the past six years and the same. 1 In this Act unless the contrary intention appears. There are virtually millions of.

The student will be required to return all course materials. The landlord must be a taxpayer with rental income under subsection 4a and subsection 4d Income Tax Act 1967. If Marks German tax liability on the 13500 is 1500 once converted from EUR the foreign tax credit of 200 will reduce his German liability.

As per the Income Tax Act whatever professional tax. This was highlighted in the revised Guidelines for Application Of Approval Under Subsection 446 Of The Income Tax Act 1967 dated 15 May 2019. In such instances tax residents will be exempted from paying personal income tax in Malaysia.

Applicable for last three years FY 2023-24 FY 2022-21 FY 2020-21. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. According to the Income Tax Act 1961 the residential status of a person is one of the important criteria in determining the tax implications.

He has only visited his parents for a week twice a year during this time. Such income under. Any amount paid outside India that is liable for tax exemption under Sec.

In India the first Income Tax Act was introduced in 1860. Taxation in Iran is levied and collected by the Iranian National Tax Administration under the Ministry of Finance and Economic Affairs of the Government of IranIn 2008 about 55 of the governments budget came from oil and natural gas revenues the rest from taxes and fees. 90 or income tax deduction under Sec.

A bank or a finance company licensed or deemed to be licensed under the Banking and Financial Institutions Act 1989. Agreement Between The Government of Malaysia and The Government of the Republic of India for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income. Will be taxed at a rate of 30 percent plus cess and surcharges.

91 is regarded to never have been allowable per Sec.

Preloved Malaysia Income Tax Act 1967 With Complete Regulations And Rules 7th Edition Wolters Kluwer Hobbies Toys Books Magazines Textbooks On Carousell

Legally Yours Can Cryptos Be Taxed Steemit

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Taxation In Malaysia 2020 1 Although The Income Tax Chegg Com

Buy Income Tax Act 1967 Act 53 With Selected Regulations Rules As At 10th April 2022 Law Books Malaysia Joshua Legal Art Gallery

Tutorial 1 Tutorial 1 Introduction To Malaysian Taxation Amp Tax Residence Of Individuals Studocu

Pdf Complexity Of The Malaysian Income Tax Act 1967 Readability Assessment Semantic Scholar

Section 44bba Of Income Tax Act 1961 Sorting Tax

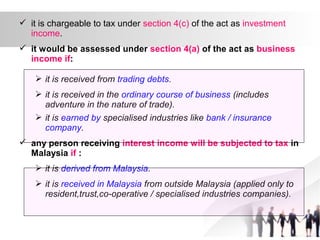

Taxation Principles Dividend Interest Rental Royalty And Other So

Taxation Principles Dividend Interest Rental Royalty And Other So

Comprehensive Malaysia Data Retention Schedule Data Retention Schedule Filerskeepers

Income Tax Act Of Malaysia Apk Voor Android Download

Malaysia Personal Income Tax Guide 2020 Ya 2019

Mwka Online Talk Am I A Tax Resident In Malaysia

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Wolters Kluwer Malaysia Cch Books Malaysia Income Tax Act 9th Ed

Wolters Kluwer Malaysia Cch Books Malaysia Income Tax Act 1967 With Complete Regulations And Rules 10th Edition

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

0 Response to "income tax act malaysia"

Post a Comment